הגשת דרישות ביטוח עשויה להרגיש מופלץ. עם זאת, לדעת כיצד עובד תהליך הגשת דרישות ביטוח הוא מרכזי. מדריך זה מטרתו לפנות בבהירות ולעזור לך בכל שלב. מההתראה הראשונה ועד הפתרון הסופי, אנו כאן כדי להפשיר את הדברים. המטרה שלנו? להפוך את התהליך לקל לכולם. עם המידע הנכון, תהיה מוכן לטפל בדרישות שלך בביטחון.

מסקנות מרכזיות

- להבין את חשיבות הגשת דרישות ביטוח בצורה נכונה.

- להכין תיעוד נחוץ כדי לקידם את התהליך.

- להתנסח עם סוגי דרישות ביטוח שונים.

- לעקוב אחרי מדריך שלב אחר שלב להגשת דרישה יעילה.

- להישאר מאורגן ולעקוב באופן קבוע לתוצאות הטובות ביותר.

הבנת דרישות ביטוח

דרישות ביטוח הן מרכזיות ביחס בין בעלי הפוליסה לחברת הביטוח. זהן בקשות רשמיות לתשלום לאחר אובדן. האובדן עשוי להיות עקב תאונות רכב, גניבות או אירועים טבעיים. המונח מתמקד בצורך בשיחות ברורות בין כל הצדדים המעורבים.

מהו דרישת ביטוח?

דרישת ביטוח מתחילה את התהליך לכיסוי אובדנים כלכליים. כל דרישה דורשת מסמכים וראיות שעומדות בתקנים מוגדרים. האיגוד הלאומי של שלטונות הביטוח (NAIC) מספק את התקנים הללו. הבנת הפרטים הללו עוזרת בטיפול במורכבויות של תהליך ההגשה.

חשיבות הגשת דרישות

הגשת דרישות היא חיונית לקבלת עזרה כלכלית כאשר היא הכי נחוצה. זה מאפשר לאנשים להתאושש מאובדנים בלתי צפויים. שלא להגיש דרישה או להגיש פחות מהנדרש עשוי לפגוע במשאבים במידה רבה לאורך זמן. המכון למידע ביטוחי מעיד על כך שהרבה אנשים מפספסים הזדמנויות לקבל חזרה על הכסף ששילמו, מה שמדגיש את חשיבות ההגשה בזמן ובצורה נכונה.

סוגי דרישות ביטוח

קיימים סוגים שונים של דרישות ביטוח לכיסוי אובדנים כלכליים. הבנת סוגי הדרישות הללו עוזרת להבין טוב יותר את תהליך הדרישות.

דרישות ביטוח בעלי בתים

דרישות ביטוח בעלי בתים

כוללים נזקים לבתים. שריפות, גניבות ואירועים טבעיים הם סיבות נפוצות לדרישות. FEMA אומרת כי דרישות שריפה עשויות להיות גדולות, ומדגישה את הצורך בכיסוי טוב.

דרישות גניבה דורשות דיווח למשטרה ורשימה של פריטים שנגנבו.

דרישות ביטוח רכב

דרישות רכב כוללות אירועי רכב כמו תאונות וגניבות. מכון מידע אובדן בכביש מראה כי תאונות נובעות לעיתים קרובות בדרישות מורכבות. חשוב לתיעוד התאונה בצורה טובה ולקבל דו"ח משטרתי כדי לקבל פיצוי נכון.

דרישות ביטוח בריאות

דרישות בריאות מכסות תשלומים עבור שירותי רפואה. ל-CMS יש כללים להגשת דרישות אלה, כולל כל המסמכים הנדרשים. חשוב לדעת מה מכסה הפוליסה שלך ומה היא מוחקת.

מדריך להגשת תביעות לביטוח

כאשר אתה מכין תביעת ביטוח, עליך להקפיד על תיעוד המקרה שלך. תיעוד טוב יקל על ההגשה ויגביר את הסיכויים להצלחה. לדעת אילו מסמכים נדרשים ולהימנע מטעויות יעזור לך להכין את התהליך בצורה יעילה יותר.

הכנת התיעוד שלך

לפני שתתחיל את התביעה שלך, אסוף את המסמכים הנדרשים. תצטרך:

- פרטי פוליסת הביטוח: יש לך את הפוליסה מוכנה.

- דיווחי אירוע: כתוב את כל פרטי האירוע בזהירות.

- תמונות: צלם תמונות ברורות של הנזק או אזור האירוע.

תיעוד מקיף מוביל לתהליך תביעה חלק. שמירה על סדר בקבצים עוזרת לך למצוא מידע בקלות כאשר נדרש.

שגיאות נפוצות שיש להימנע

הימנעות מ-שגיאות בהגשה היא מרכזית להצלחת התביעות. להיות מודע לפחדים אפשריים עוזר להימנע מסיבוכים:

מידע לא מלא:

וודא שכל פרט מסופק נכון כדי למנוע איחורים.- קווים זמניים שגויים: עקוב אחר המועדים מאחר כי הגשות מאוחרות עשויות להידחות.

- תקשורת חלשה: תקשר בצורה טובה עם חברת הביטוח שלך ושאל שאלות במידה שאינך בטוח.

על פי מועצת מחקר הביטוח, הכנה זהירה היא קריטית להצלחת תביעות. על ידי עקיפת שגיאות נפוצות, אתה משפר את הסיכוי שלך לתביעה מוצלחת.

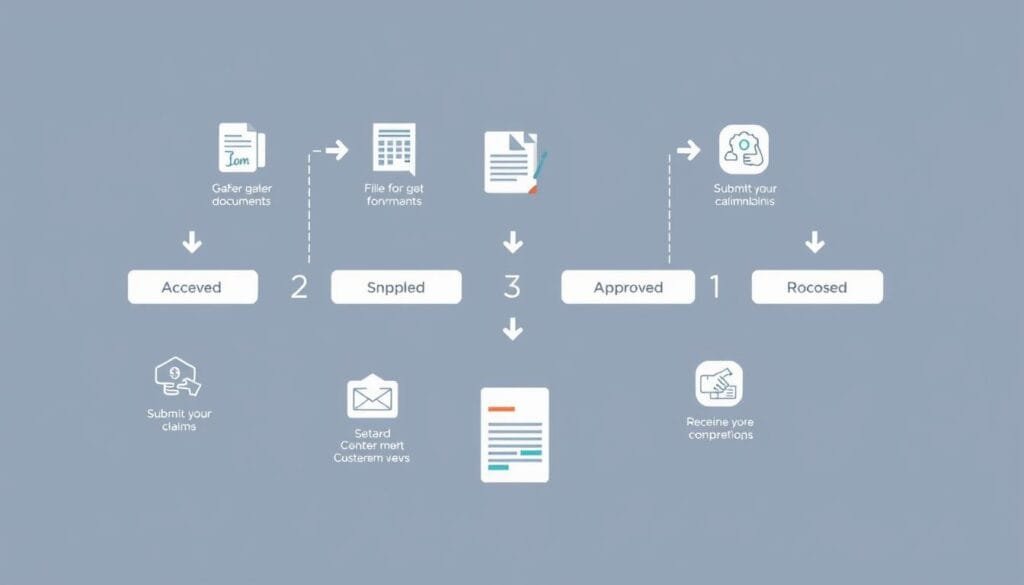

השלבים להגשת תביעה בצעדים

הגשת תביעת ביטוח יכולה להיות פחות מתסכלת אם אתה יודע אילו שלבים יש לעבור. חלק זה יראה לך איך לנהל את התביעה שלך בצורה טובה.

שלב 1: הודיע לסוכן הביטוח שלך

צור קשר במהירות עם סוכן הביטוח שלך לאחר התקרית. השלב הראשון הזה חיוני כדי להתחיל את התהליך. הסבר מה קרה בצורה ברורה ובקצרה. זה יעזור לסוכן שלך לסייע לך בצורה יותר טובה ולהדריך אותך לשלבים הבאים.

שלב 2: איסוף מידע נדרש

לפני מילוי טופס התביעה, יש לאסוף את כל המסמכים הנדרשים. תצטרך:

- מספר פוליסת הביטוח שלך

- קבלות מהאירוע

- תמונות של הנזק או האובדן

- הערכות תיקון

להכין את המסמכים הללו מראש מחזק את התביעה שלך. זה גם מאיץ את התהליך.

שלב 3: מילוי טופס התביעה

מילוי טופס התביעה בצורה נכונה הוא קריטי. ודא שכל השדות הנדרשים מולאו בלי שגיאות. השתמש בשפה ברורה וספק מידע מפורט על תביעתך. לעזרה נוספת, ניתן להסתכל על ההנחיות של הביטוח שלך או לבקש עזרה מקבוצות לצרכנים.

איך לעקוב אחרי תביעת הביטוח שלך

ללמוד לעקוב אחרי תביעת הביטוח שלך עוזר להפוך את התהליך לחלק. עם טכנולוגיה חדשה, כדאי להשתמש בכלים מקוונים שמציעים הרבה מביטחים. כלים אלה מעדכנים בזמן אמת, מאפשרים לך לעקוב אחרי מצב התביעה שלך.

שימוש בפורטלים מקוונים

רבים מביטחני הביטוח מציעים פורטלים מקוונים שנועדו למעקב אחר תביעות. כדי להשתמש בפורטלים אלו בצורה יעילה, הנה מה שעליך לעשות:

- התחבר לחשבונך עם הפרטים שלך.

- עבור לאזור התביעות כדי לראות את התביעות שלך.

- בחר בתביעה שברצונך לעקוב אחריה למידע נוסף.

- חפש חדשות בנוגע לתביעה שלך, כמו מסמכים שנדרשים או שלבים הבאים.

יצירת קשר עם נציג הביטוח שלך

חשוב לשמור על קשר עם נציג הביטוח שלך. כאשר אתה פונה אליו, עקוב אחרי הטיפים הבאים:

- חשוב לחשוב על שאלות או דאגות שיש לך מראש.

- שאל לגבי המידע האחרון על ביקורות או מסמכים שנדרשים לתביעה שלך.

- רשום כל שיחה, כולל תאריכים ונקודות מרכזיות, לרשומות שלך.

עם כלי מקוונים ושיחות קבועות עם נציג הביטוח שלך, תרגיש יותר בשליטה. בכך, תמיד תהיה מעודכן לגבי ההתקדמות בתביעה שלך.

מה לצפות במהלך התביעות

חשוב לדעת מה קורה כאשר אתה מגיש תביעת ביטוח. כל תביעה נבדקת בקפידה. זה עשוי לקחת זמן שונה, תלוי בתביעה ובגורמים אחרים. הנה מה שעליך לצפות בו במהלך בדיקת התביעה, כולל תוצאות אפשריות.

ציר זמן לבדיקת טענות

חברות ביטוח רוצות לבדוק טענות במהירות וביעילות. בממוצע, הבדיקות עשויות לקחת מכמה ימים עד מספר שבועות. הזמן הנדרש עשוי להיות מושפע מכמה דברים:

- השלמות של המידע שסופק

- טבע הטענה

- יכולות העיבוד הפנימי של הביטוח

טענות פשוטות ומתועדות היטב לעתים תזוז במערכת מהר יותר. אך טענות שדורשות חקירה נוספת עשויות להישהות. כדי לעזור לדברים לזוז בצורה חלקה, ודאו שכל התיעוד שלכם הוא שלם.

תוצאות אפשריות

התוצאה של טענה עשויה להשפיע על מה שאתם עשויים לעשות לאחר מכן. בדרך כלל, טענות עשויות להוביל לשלוש תוצאות:

- מאושר: הטענה שלכם מתקבלת, ואתם מקבלים תשלום.

- נדחה: הטענה אינה עומדת בקריטריוני הביטוח.

- תחת חקירה: הביטוח זקוק למידע נוסף לפני שהחלטה תילקח.

אם הטענה שלכם מאושרת, עליכם לקבל את הפיצוי שלכם בקרוב. אם היא נדחתה, ייתכן שתוכלו לערער על ההחלטה עם ראיות חדשות או באמצעות ערעור. טענות שנמצאות תחת חקירה תישארו פתוחות עד שכל הפרטים ייסדרו.

| תוצאה | פעולה נדרשת | גרף זמן לשלב הבא |

|---|---|---|

| מאושר | קבל פיצוי | 1-2 שבועות |

| נדחה | סקור את מכתב הדחייה ושקול לערער | משתנה, בדרך כלל תוך 30 ימים |

| תחת חקירה | ספק מידע נוסף הנדרש | משתנה, על פי צרכי הביטוח |

טיפים לחוויית טיפול בתביעה מוצלחת

כמה אסטרטגיות מרכזיות עשויות לשפר את תהליך התביעות בביטוח. השימוש בטיפים אלה עשוי לסייע בהאצת התהליך ובהובלת תוצאות טובות יותר.

היו כנים ושקופים

היות כנים עם חברת הביטוח שלך חשוב. תמיד נתנו לה את הפרטים המלאים והאמיתיים. חוסר כנות עשוי להקשות על התהליך או אפילו לגרום לדחיית תביעה. אמון מאיץ את התהליך.

עקוב באופן קבוע

אל תתיר את התביעה שלך להישכח על ידי בדיקה תדירה. זה מראה שאתה מעורב בפעילות. זה צעד חכם לוודא שהתביעה שלך מטופלת במהירות.

הישאר מאורגן

שמור על סידור טוב של המסמכים והאימיילים שלך. השתמש בתיק או גליון לעקוב אחר הכל. בכך, לא יתפספס דבר חשוב וזה יהיה קל יותר לעקוב.

מסקנה

כדי לסיים, הבנת תהליך התביעות היא מרכזית להצלחה. על ידי התכוננות ולמידה על תביעות שונות, תוכל לנווט בהגשת התביעה בצורה יותר טובה. הבנת הידע הזה נותן לך ביטחון.

עקוב אחר השלבים והטיפים שמשותפים במדריך זה לתהליך דיון טוב. להיות מאורגן, כנה ולשמור על קשר עוזר לטפל בביטוחנים בצורה קלה יותר. השתמש במדריך זה כמשאב כדי לשמור על אסטרטגיה חזקה.

להיות מודע זה חיוני עם דרישות ביטוח. לדעת מה לצפות ולפעול מוקדם משפר את הסיכויים שלך לתוצאה טובה. עמוד בדרישותיך בביטחון, ודע שיש לך את מה שנדרש כדי להצליח.