ביטוח רכב עשוי להיות מבלבל, אך חיוני להבין את היסודות. מדריך זה יעזור לך לחקור סוגים שונים של כיסוי וגורמים מרכזיים המשפיעים על דמי הפרמיום. תלמד כיצד לבחור בחוכמה ולמצוא את המדיניות הטובה ביותר עבור הרכב שלך.

אנו נכסה סוגי ביטוח שונים ומהם הגורמים המשפיעים על עלויותיך. עד סיום המדריך, תהיה מוכן לבחור את הכיסוי הנכון להגנת הרכב והכספים שלך.

מסקנות מרכזיות

- ביטוח רכב מגן על הרכב והכספים שלך במקרה של תאונות או אירועים.

- סוגי הכיסוי כוללים אחריות, התנגדות, כללי, ואפשרויות נוספות כמו הגנת נהגים לא מבוטחים.

- גורמים כמו רשומת נהיגה, מיקום, וסוג הרכב משפיעים על דמי הביטוח שלך.

- הבנת דרישות המדינה חיונית בעת בחירת מדיניות ביטוח רכב.

- השוואת הצעות ממספר ספקים כדי למצוא את הכיסוי הטוב ביותר לצרכים ולתקציב שלך.

הבנת יסודות ביטוח רכב

ביטוח רכב יכול להיות מסובך, אך לדעת את היסודות היא מרכזית. בואו נתעדף בסוגי הכיסוי ובמה שמשפיע על תעריפיך.

סוגי כיסוי ביטוח רכב

ביטוח רכב מציע מספר סוגים חשובים של כיסוי:

- כיסוי אחריות: מגן עליך כלכלית אם אתה גורם נזק או פציעה לאחרים בתאונה.

- כיסוי התנגשות: מכסה את עלות תיקון או החלפת הרכב שלך אם נפגע בהתנגשות עם רכב אחר או עם עצם.

- כיסוי כללי: מגן על הרכב שלך מנזקים שאינם קשורים להתנגשות, כגון גניבה, נזק כתוצאה מפעולות זינוק או פגע טבעי.

- כיסוי נהגים לא מבוטחים/נהגים עם ביטוח מוגבל: מכסה אותך אם אתה מעורב בתאונה עם נהג שיש לו ביטוח בלתי מספיק או אין לו ביטוח.

גורמים המשפיעים על תעריפי ביטוח

הרבה דברים יכולים להשפיע על עלויות הביטוח שלך. הרשומה הנהיגה שלך משחקת תפקיד חשוב בהגדרת התעריפים שלך.

הסוג של הרכב שאתה נוהג גם חשוב. ישנם רכבים שעלות התיקון או ההחלפה שלהם יקרה יותר.

המקום בו אתה גר משפיע גם על הדמיון שלך. עלויות מקומיות, רמות פשיעה וסטטיסטיקות של תאונות משחקות תפקיד.

- רשומת נהיגה: ההיסטוריה שלך של תאונות, הפרות תנועה ותביעות עשויים להשפיע באופן משמעותי על דמי הביטוח שלך.

- סוג הרכב: היצרן, הדגם והגיל של הרכב שלך עשויים להשפיע על עלות הכיסוי, מאחר שישנם רכבים שהם יקרים יותר לתיקון או להחלפה.

- מיקום: המקום בו אתה גר יכול גם לשחק תפקיד, מאחר שדמי הביטוח עשויים להשתנות בהתאם לעלויות המקומיות למגורים, רמות הפשיעה והסטטיסטיקות של תאונות.

- סכום הפרישה: בחירת פרישה גבוהה יכולה להוריד את דמי הביטוח החודשיים שלך, אך זה גם אומר שתצטרך לשלם יותר מהכיס שלך במקרה של תביעה.

- ציון אשראי: במדינות מסוימות, חברות ביטוח עשויות לשקול את ההיסטוריה הכספית שלך בעת קביעת דמי הביטוח שלך, מאחר שזה עשוי להיות מצב רגשי של אחריות פיננסית.

לדעת את החלקים המרכזיים הללו של ביטוח רכב עוזר לך לבחור בחוכמה. תוכל למצוא את הכיסוי הטוב ביותר לצרכים ולתקציב שלך.

| סוג הכיסוי | הגדרה | יתרונות |

|---|---|---|

| אחריות | מכסה נזקים ופציעות שנגרמו לאחרים בתאונה | מגן עליך מאחריות כספית אם נמצאת אשמה |

| התנגשות | מכסה את עלות תיקון או החלפת הרכב שלך אם נפגע בתאונה | עוזר לך להחזיר את הרכב לדרך לאחר תאונה |

| מקיף | מכסה נזקים שאינם קשורים להתנגשות, כגון גניבה, חנזה או אסונות טבע | מגן על הרכב שלך גם כאשר אינך נהג |

| נהג לא מבוטח/נהג עם ביטוח לא מספיק | מכסה אותך אם נמצאת מעורבת בתאונה עם נהג שיש לו ביטוח לא מספיק או אין לו ביטוח | וודא שאתה מוגן גם אם הנהג השני אינו מבוטח |

כיסוי אחריות: הגנה פיננסית על עצמך

כיסוי אחריות הוא חלק חיוני בביטוח רכב. הוא מגן על הנהגים פיננסית אם הם גורמים לתאונה. כיסוי זה עוזר לשלם פיצויים או תשלומים עבור נזקים או פציעות לאחרים בדרכים.

כיסוי אחריות מגן על הנכסים שלך מלהיות לקחים לשלם על הוצאות תאונה. רב מדינות דורשות כיסוי אחריות לרכב על פי חוק. זה מבטיח שהנהגים יש להם הגנה פיננסית בסיסית.

שני סוגי כיסוי אחריות עיקריים הם:

- אחריות פציעת גוף: כיסוי זה משלם על הוצאות הרפואה והשכר של הנהג השני והנוסעים שלו אם נמצאת באשמה בתאונה.

- אחריות נזק רכוש: כיסוי זה משלם על תיקון או החלפת רכב הנהג השני וכל נזק רכוש אחר שאולי גרמת.

בחירת הגבולות הנכונים של כיסוי אחריות לרכב עשויה להיות מסובכת. זה תלוי בנכסים שלך, היסטורית הנהיגה שלך וחוקי המדינה. מומחה בביטוח יכול לעזור לך לקבל את התמיכה המתאימה

הגנת כספית.

"כיסוי אחריות הוא היסוד של כל פוליסת ביטוח רכב מקיפה. הוא מגן על רווחתך הכספית במקרה של תאונה, מבטיח שלא תצטרך לסבול לבד את משקל התיקונים היקרים או ההוצאות הרפואיות."

כיסוי התנגשויות וכיסוי מקיף

כיסוי התנגשויות וכיסוי מקיף הם אפשרויות ביטוח רכב חיוניות. הן מגנות עליך כלכלית אם הרכב שלך נפגע. תוכניות אלו מכסות סוגים שונים של אירועים המעורבים ברכב שלך.

הבנת כיסוי התנגשויות

כיסוי התנגשויות מגן על הרכב שלך אם הוא מתנגש ברכב אחר או בפריט. הוא גם מכסה הפיכות. כיסוי זה עוזר לשלם על תיקונים או החלפה אם הנזק הוא נרחב.

זה חשוב במיוחד עבור רכבים חדשים או יקרים יותר. עלויות התיקון של רכבים אלה עשויות להיות גבוהות מאוד.

כיסוי מקיף: הגנה נגד סיכונים נוספים

כיסוי מקיף מגן נגד סיכונים שאינם קשורים להתנגשויות. הוא מכסה גניבות, נזקי ונדיבה, אסונות טבע ואירועים הקשורים לחיות. תוכנית זו עוזרת לך להחליף או לתקן את הרכב שלך אם נפגע מאירועים שאינם ברי-שליטה.

שני הכיסויים, כיסוי התקרית ו־כיסוי מקיף, מציעים הגנה ערכית. הם מעניקים שקט נפשי וביטחון כלכלי כאשר הם נחוצים ביותר.

שקול את צרכיך המסוימים בעת בחירת אפשרויות הביטוח הללו. זה יעזור לך לקבל החלטה מושכלת להגנת הרכב שלך.

"הכיסוי לתאונות וה-כיסוי המקיף הם חיוניים להגנת ההשקעה שלך ברכב, ומבטיחים שתוכל לחזור לדרך במהירות ועם מינימום עומס כלכלי."

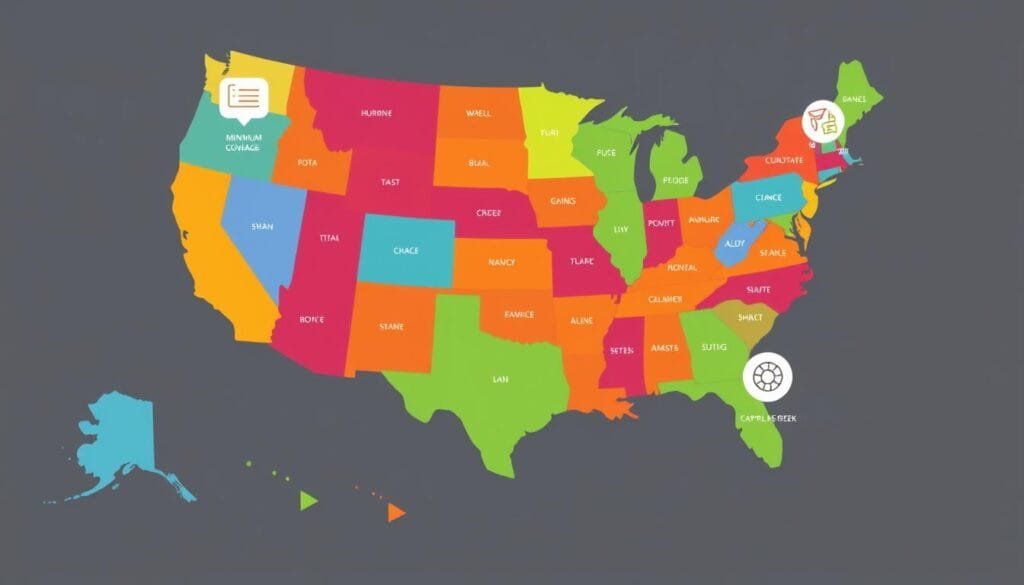

ביטוח רכב: דרישות המדינה והמינימום

הבנת דרישות ביטוח רכב ספציפיות למדינה חיונית. כל מדינה קובעת את חוקיה לרמות הכיסוי המינימליות. הבנת ההנחיות הללו עוזרת לך לקבל החלטות מושכלות לגבי צרכי הביטוח שלך.

דרישות הביטוח לרכב במדינה כוללות בדרך כלל כיסוי אחריות. זה משלם פיצויים עבור נזקים ופציעות שאתה גורם לאחרים בתאונה. רוב המדינות חייבות ברמות מינימליות של ביטוח אחריות.

רמות אלו נצפות לעיתים כשלושה מספרים, כמו 25/50/20. הם מייצגים גבולות כיסוי עבור פציעה גופנית לאדם, לתאונה, ולנזק רכוש לתאונה.

| מדינה | כיסוי אחריות מינימלי |

|---|---|

| קליפורניה | 15/30/5 |

| טקסס | 30/60/25 |

| ניו יורק | 25/50/10 |

| פלורידה | 10/20/10 |

יש מדינות שעשויות לדרוש גם כיסוי ביטוח רכב מינימלי להגנה על פצועים אישיים (PIP). גם הגנה על נהגים לא מבוטחים או מבוטחים באופן לא מספיק עשויה להיות חובה. אלו מציעים הגנות פיננסיות נוספות בתאונות.

לדעת את דרישות ביטוח הרכב של המדינה שלך חיוני. זה מבטיח שאתה מוגן בצורה תקינה בכביש. זה גם עוזר לך להימנע מבעיות משפטיות מכך שאינך עומד בסף הנדרש.

ביטוח רכב: השוואת הצעות וספקים

למצוא את הביטוח הרכב הנכון יכול להיות קשה. השוואת הצעות וספקים עוזרת לנהגים לקבל החלטות חכמות. כלים מקוונים הפכו את התהליך הזה לקל יותר.

משאבים מקוונים להשוואת הצעות

הרבה אתרים ואפליקציות מציעים שירותי השוואת הצעות לביטוח רכב. נהגים יכולים להזין את המידע שלהם ולקבל הצעות ממספר ספקים. הפלטפורמות הללו מציגות השוואות צד לצד של כיסוי, עצירות ועלויות.

נהגים יכולים לחקור במהירות אפשרויות ביטוח שונות עם הכלים הללו. זה עוזר להם למצוא כיסוי המתאים לצרכיהם ולתקציבם.

אתרי ספקי ביטוח מציעים גם הצעות מחיר ישירות. נהגים יכולים לקבל הצעות ממובילי ביטוח מסוימים. זה מאפשר להם להעריך את ההצעות והתעריפים מחברות פרטיות.

שימוש בשני פלטפורמות השוואה ובהצעות ישירות נותן לנהגים תמונה מלאה. הם יכולים להבין את שוק הביטוח לרכב טוב יותר ולקבל החלטות מושכלות.